Improve the financial health of your customers to improve your business.

Our white-label products harness the power of behavioral science to help your customers manage their finances, enhancing your relationship, your business opportunities, and your brand.

Schedule a Demo

Deploy in one day and...

-

Better understand your customers through access to new data and insights.

-

Improve the financial health of your customers through automated, personalized guidance.

-

Create new business by knowing what your customers need and having the engaged channels to offer it.

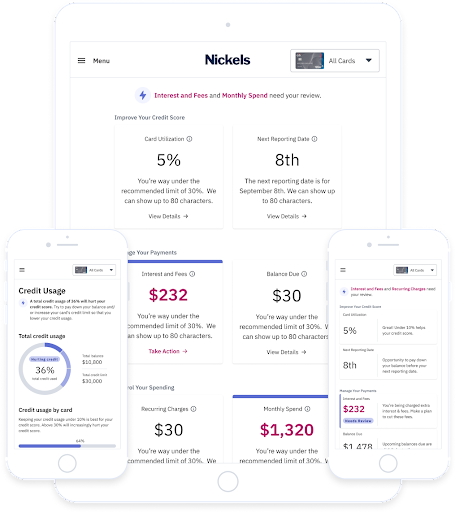

Product Spotlight: Credit Card Coach

By helping your customers manage their credit card debt, you unlock new business opportunities.

Credit Card Debt

- 45% of US households carry a credit card balance

- $6k average credit card balance carried

- $116B extra interest and fees charged

This debt and the accompanying charges leave your customers with fewer banking opportunities.

Nickels centralizes card management for banks’ customers, saving money and driving new loans.

-

Major credit cards

-

Credit Card Coach

-

Customers

Bank Benefits

-

Immediate $819B refinance opportunity.

-

Improved customer FICO scores.

-

New loan opportunities

Meet Nickels: a team with a track record of successful and scalable behavioral interventions.

Nickels is built by a team with a history of designing and delivering software that improves the world at scale.

Learn more >

You've already gotten this far...

Help your customers manage the largest and most problematic debt categories they’re facing today.

Request a Demo